- Financial Fluency

- Posts

- From £450 to £40,000: A Family Investment Story

From £450 to £40,000: A Family Investment Story

How one 1975 share purchase beat currency debasement

In partnership with Communicate Business English Teaching English - Talking Business Cambridge results that speak for themselves. Communicate is the language training company behind this newsletter — and behind a 100% Cambridge pass rate for 2024–25. This year, 44% of students achieved Grade A, nearly 3x the global average. We focus on what works: ✔️ Small group classes ✔️ A complete syllabus ✔️ Expert coaching on exam technique Whether you're preparing for an exam or improving your English for work, we help you get results. |

Welcome to Financial Fluency - your weekly guide to mastering financial English, learning how money works, and making confident financial choices.

In this issue:

A Look at the Markets: AstraZeneca plc

From £450 to £40,000: A Family Investment Story

Quote of the Day: Warren Buffett

We value your feedback

Word of the Day: Blue Chip

Your investment insights

Whenever you are ready, here is how I can help you

A Look at the Markets: AstraZeneca plc

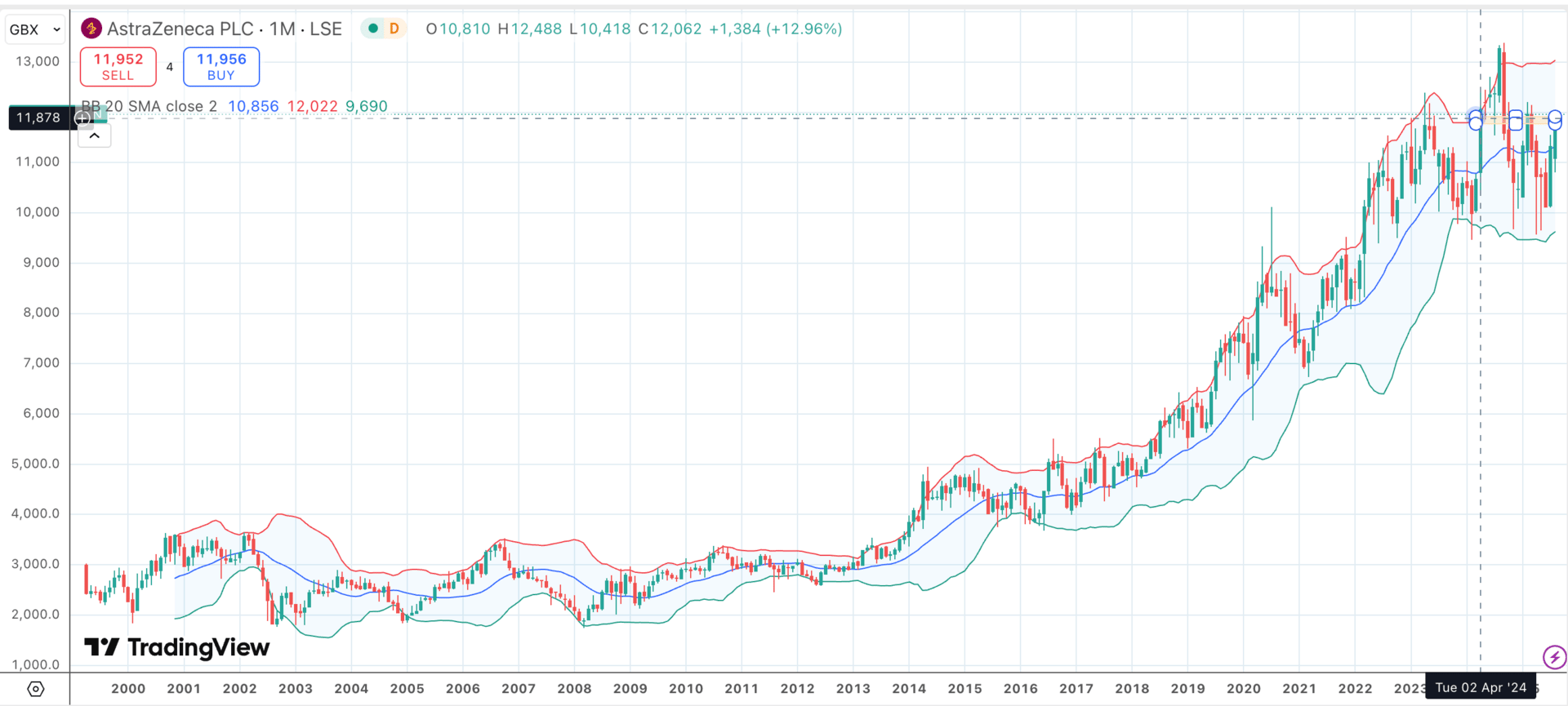

AstraZeneca plc 1999 - 2025 - TradingView

The chart shows AstraZeneca's performance since its creation in 1999. It demonstrates approximately 5.8% annual capital growth, with dividends adding another 2-3%, for total returns around 8-9%. My mother's slightly higher returns reflected her earlier entry point and the benefit of the original ICI investment structure.

From £450 to £40,000: A Family Investment Story

How one 1975 share purchase beat currency debasement

Over the last four newsletters, we have discussed why saving is difficult but also why I believe investing is important.

In the upcoming newsletters, I want to look at how we can try and counter debasement of currency by investing in assets. I want to start this week with an example from my own family history.

Decisions they made 50 years ago continue to benefit my life today.

A £450 Blue Chip Investment

During 1975, my mother bought some shares in ICI (Imperial Chemical Industries).

I do not have the exact figures on record, but I believe the total cost was approximately £450. ICI was a British blue chip company, founded in 1926 and a constituent of the FTSE indices. My mother saw it as a solid, dividend-paying investment, but I do not believe she realised the impact on building long-term wealth.

The strategy was simple: buy and hold.

ICI to AstraZeneca

Like many companies, ICI transformed over the years.

In 1993, ICI split its pharmaceutical division into a separate company called Zeneca, so my mother suddenly owned shares in both companies. Six years later, Zeneca merged with Swedish company Astra AB to create AstraZeneca. The original chemical company had transformed into a global pharmaceutical business.

By 1999, my mother's £450 investment had become two companies worth a combined value of approximately £6,000.

Retirement Income

My mother took early retirement (she was a primary school teacher in Edinburgh) in 1988.

The dividends from initially ICI and then AstraZeneca formed an important part of her retirement income. ICI was taken over in 2008 and my mother received a payout. I do not have the records but I guess it will be at least twice her initial investment.

More importantly though, she held the AstraZeneca shares for the rest of her life until she died in 2021.

Multi-Generational Financial Foundation

On her death these AstraZeneca shares passed to me.

Her £450 investment in 1975 is now worth over £40,000 and generates annual dividends of approximately £1,000. To put this in perspective, the UK state pension provides around £1,000 per month (though I am still many years away from retirement). The principle scales: several such investments could provide substantial protection for your financial future and contribute significantly to a more comfortable retirement.

I have many reasons to be grateful to my mother, and her long-term investment discipline is certainly one of them.

Beating Currency Debasement

We started this newsletter looking for assets that can counter the effects of inflation and debasement of currency.

I wanted to use a real example to give readers context. ICI was only one of my mother's investments, but taking into account the ICI buyout and decades of dividends, this single investment probably achieved around 9-10% annual compounded returns. What is surprising is that these returns are in line with a broader index such as the S&P 500.

This suggests that equities, whether individual stocks or indices, offer genuine protection against currency debasement.

Final Thoughts

These returns look good on paper and are certainly better than holding money in the bank. While experts debate the exact rate of currency debasement, this story demonstrates why investing in productive assets remains essential for protecting your financial future.

Next week we will look at a more modern and easier way to invest in stocks with less risk.

Note: The numbers in this newsletter are estimates based on available records and historical research, as complete family financial records from this 50-year period no longer exist.

As always, none of this is financial advice. Everyone should invest according to their personal circumstances, risk tolerance and financial goals.

Quote of the Day: Warren Buffett

This famous quote also sums up my mother's approach to investing. She bought quality shares in 1975 and held them for nearly 50 years, through multiple corporate transformations, market crashes, and economic cycles.

We Value Your Feedback!

Your opinion helps us improve and lets you suggest topics or ask Business English questions for future issues.

How did you find this week’s newsletter? |

Word of the Day: Blue Chip

Blue Chip - adjective/noun - describes large, well-established companies with a long history of reliable performance, stable earnings, and regular dividend payments; considered safe, high-quality investments.

"ICI was a British blue chip company, the kind of investment that seemed sensible for building long-term wealth."

Context and Usage: Blue chip companies are typically market leaders in their industries with strong financial positions and proven track records. The term comes from poker, where blue chips traditionally have the highest value. For investors, blue chip stocks represent quality and reliability, though they may grow more slowly than smaller, riskier companies.

Note: Blue chip status can change over time as companies evolve or decline. What matters most is the underlying business quality and management, not just the historical reputation.

Common Collocations:

Blue chip stocks - shares in large, established companies Many pension funds focus on blue chip stocks for their stability and dividend income.

Blue chip company - a well-established, financially sound corporation

AstraZeneca has maintained its blue chip status through decades of pharmaceutical innovation.

Blue chip investment - putting money into high-quality, established businesses Her blue chip investment strategy prioritised stability over rapid growth.

Blue chip portfolio - a collection of investments in established companies Building a blue chip portfolio requires patience and focus on long-term fundamentals.

Business Example: The investment committee recommended blue chip companies for the conservative portion of the fund, seeking reliable dividend income over speculative gains.

Investment Context: Blue chip companies often form the foundation of long-term investment portfolios. While they may not provide explosive growth, their stability and dividend-paying ability make them valuable for wealth preservation and income generation across multiple decades.

Your investment insights

Share your thoughts and help us shape the next issue of Financial Fluency!

Have you ever held a stock for more than 5 years? |

Which part of this newsletter was most useful to you? |

Whenever you are ready, here is how I can help you:

We provide Business English lessons and Cambridge and IELTS preparation courses.

You can book a free 20-minute consultation with Iain over Zoom here:

Why not subscribe to our sister Business Fluency newsletter? It helps English students master essential business terms and provides practical strategies to boost your career prospects.

Disclaimer:

This newsletter is for informational and educational purposes only and should not be construed as financial advice. The information contained herein is generic and does not take into account your individual financial circumstances. You should always consult with a qualified financial professional before making any investment or financial decisions.

Additionally, the authors and/or publishers of this newsletter may hold investments in securities or other financial instruments mentioned herein. These are included for illustrative purposes only and should not be taken as a recommendation to buy or sell such securities or financial instruments.