- Financial Fluency

- Posts

- How Anthony Scaramucci Turned $1,200 Into $288,000 By Doing Nothing!

How Anthony Scaramucci Turned $1,200 Into $288,000 By Doing Nothing!

Why forgetting about your investments can be your best strategy

The Hustle: Claude Hacks For Marketers

Some people use Claude to write emails. Others use it to basically run their entire business while they play Wordle.

This isn't just ChatGPT's cooler cousin. It's the AI that's quietly revolutionizing how smart people work – writing entire business plans, planning marketing campaigns, and basically becoming the intern you never have to pay.

The Hustle's new guide shows you exactly how the AI-literate are leaving everyone else behind. Subscribe for instant access.

Welcome to Financial Fluency - your weekly guide to mastering financial English, learning how money works, and making confident financial choices.

In this issue:

A Look at the Markets: Performance November 2025

How Anthony Scaramucci turned $1,200 into $288,000 by doing nothing!

Quote of the Day: Anthony Scaramucci

We value your feedback

Word of the Day: Rebalancing

Interactive Quiz

Whenever you are ready, here is how I can help you

A Look at the Markets: Performance November 2025

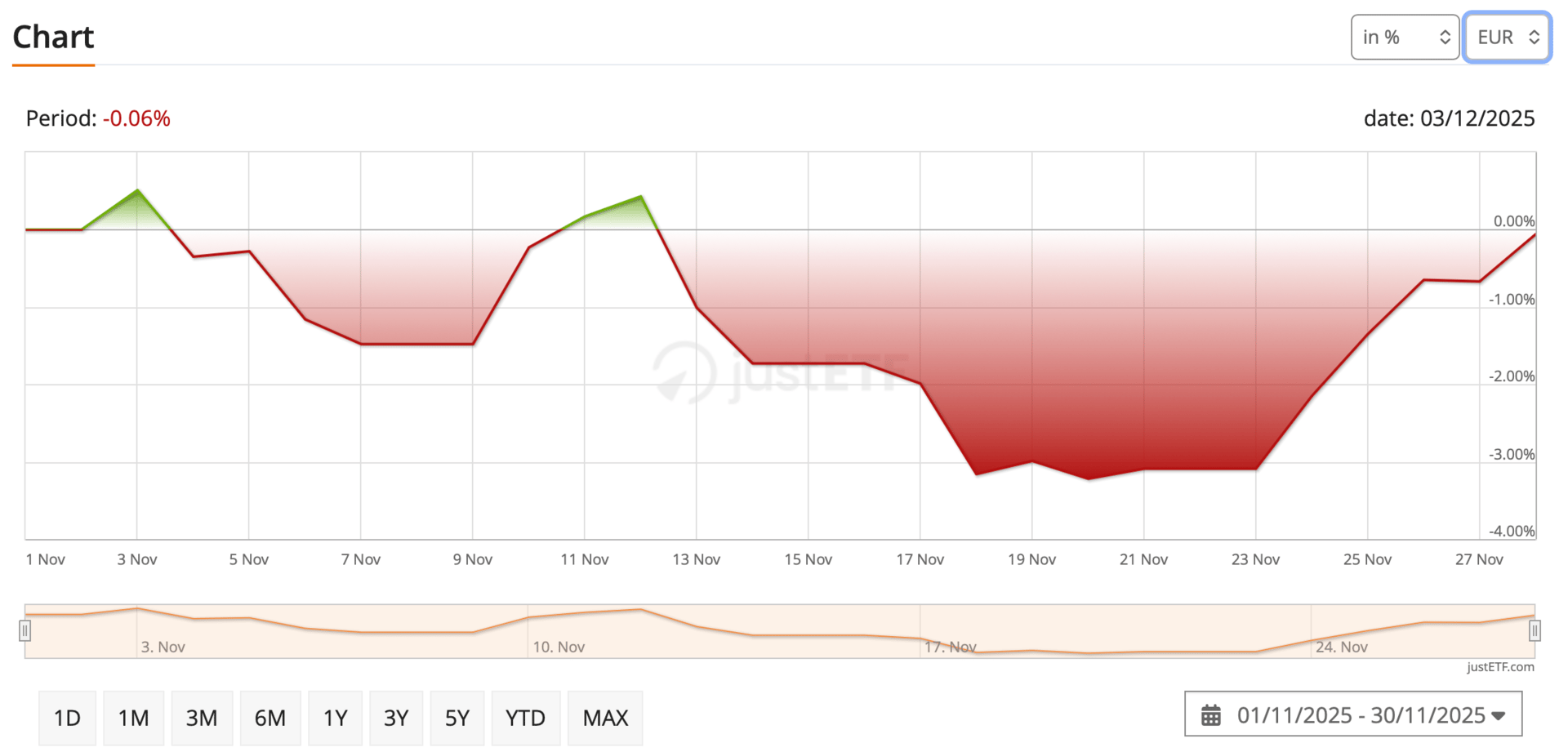

Vanguard FTSE All-Word ETF (Accumulating)

Vanguard FTSE All-Word ETF (Accumulating) JustETF.com

There is a lot of red in the above chart, but the numbers reveal that the Vanguard FTSE All-World ETF (Acc) dropped by only 0.06% in November.

We call this performance ‘flat’.

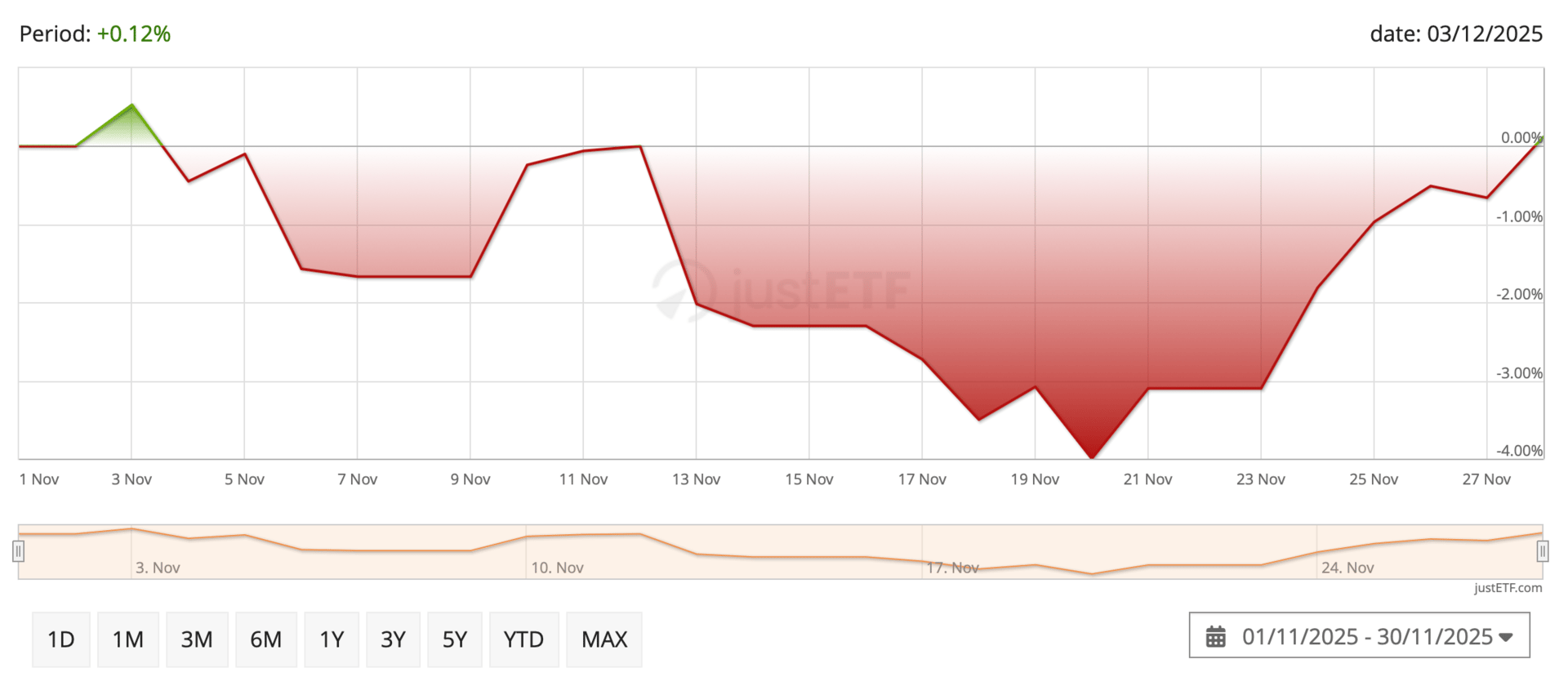

iShares Core S&P 500 UCITS ETF (Accumulating)

iShares Core S&P 500 UCITS ETF (Accumulating)

A very similar chart for the iShares Core S&P 500 UCITS ETF (Acc), which showed a very slight positive return of 0.12%.

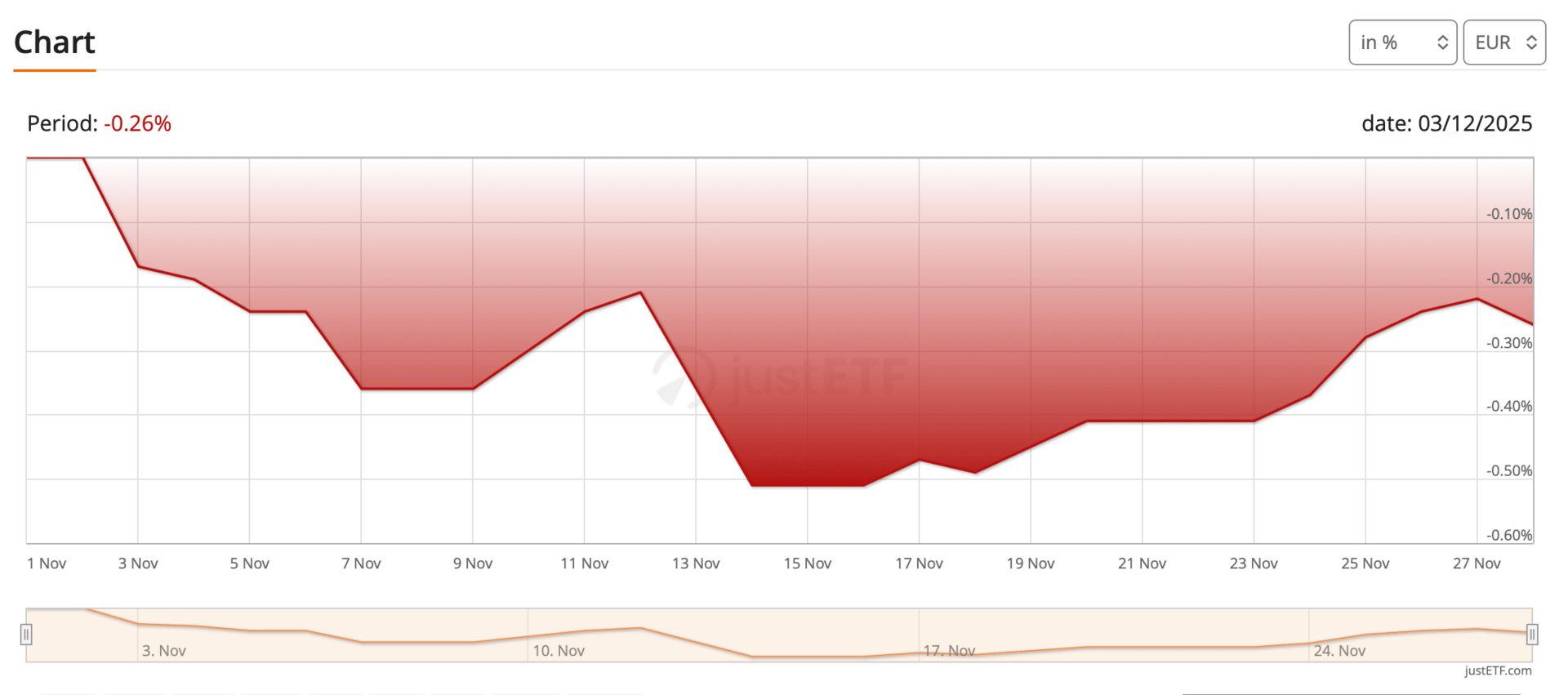

Vanguard EUR Corporate Bond ETF (Accumulating)

Vanguard EUR Corporate Bond ETF (Accumulating)

There is even more red on the above chart but the numbers reveal that the Vanguard EUR Corporate Bond ETF only dropped 0.26% in November.

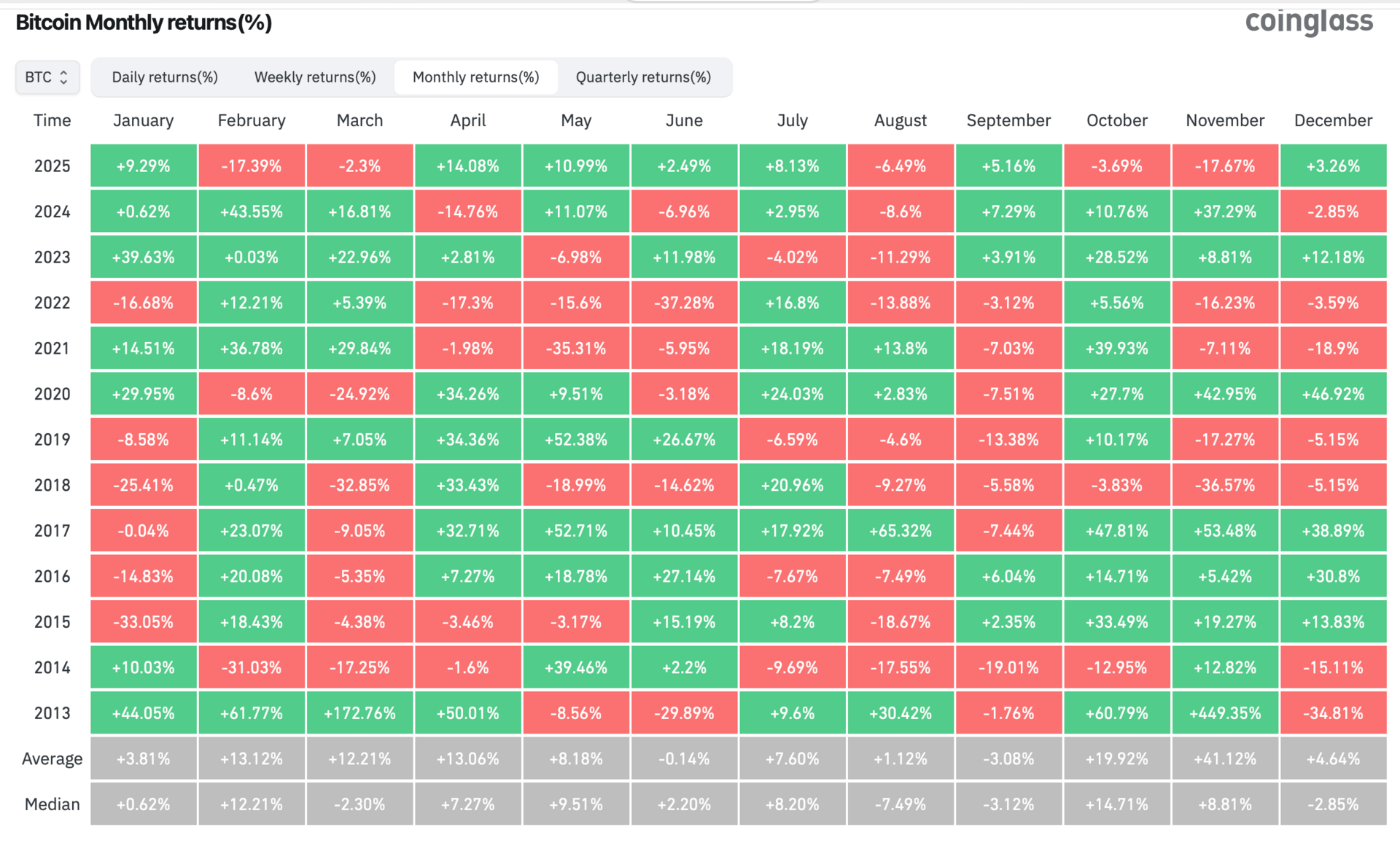

Bitcoin Monthly Performance $BTC.X ( ▼ 2.48% )

BTCUSD - Coinglass

Bitcoin suffered its worst month since June 2022 in November. However, at times like these, it is important to recognise that these movements are within Bitcoin’s normal volatility. Will we see a recovery into the end of the year?

How Anthony Scaramucci Turned $1,200 Into $288,000 By Doing Nothing!

Why forgetting about your investments can be your best strategy

Anthony Scaramucci in 2016

At this time of year, I always like to review my finances to make sure that I am on the right track for the long term.

I review my investments and decide if there is anything I should sell. I think it is good practice to do this once or twice a year, and the lead up to the end of the year is the ideal time for me.

However, lately, I try and keep in mind the following story from Wall Street financier, author and podcast host, Anthony Scaramucci.

Anthony Scaramucci's Forgotten Microsoft Shares

In October 1992, Anthony Scaramucci bought $1,200 of Microsoft shares for his newborn son, AJ. And forgot about them.

Fortunately, he had ticked the box to reinvest dividends even though Microsoft did not pay dividends at the time. In the pre-digital age, when statements were sent by post, his broker did not have his address after he had moved several times. It was 27 years later before he rediscovered the account.

In a podcast interview, Anthony Scaramucci said that his son's investment had grown to $88,000, but his son corrected him. The investment had actually grown to $288,000!

What Can We Learn From This Story?

Scaramucci clearly made an excellent investment choice, and not every stock would have performed so well.

However, he himself admits that he would have sold the shares had he remembered that he owned them. He is also very thankful that he didn't. In this case, taking no action was the best thing he could have done.

While it is very tempting to take profits, it is often best to let your winners run.

My End-of-Year Review: Global ETF

One of the main advantages of a global ETF strategy is that there is not much to do.

I take the lesson from Scaramucci's story and I do not touch my global ETF. I simply review the performance and decide if I am able to increase the monthly payments. It is a set and forget strategy that Scaramucci would approve of.

I will only start withdrawing funds when I approach retirement.

My End-of-Year Review: Fun Portfolio & Crypto

I do slightly more work with my fun portfolio of individual shares and crypto, and some of these actions may go against Scaramucci's lesson.

I do take some profits, usually if a share has grown by at least 100%. The other time I consider selling is if one investment has grown substantially and represents too big a part of my overall portfolio. Selling part of this position prevents any single investment from dominating and maintains my intended risk level. This is known as rebalancing.

I reinvest most profits into my global ETF or bonds, depending on their relative percentages in my portfolio.

Other Considerations

If the financial year in your country is the same as the calendar year, you may want to consider tax-efficient decisions. However, tax rules vary significantly by jurisdiction, so consult local regulations or advisors. This type of investment decision is beyond the scope of these newsletters other than to mention it exists.

Conclusion

As with anything in life, you should review your long-term financial goals and check if you are on track to achieve them.

However, try to avoid the temptation to trade too often. Do not get worried if you find the value of your portfolio has gone down - this is just a normal part of investing. If global markets have fallen in value, it is likely that your investments will have also dropped in value.

Finally, remember Scaramucci's lesson: sometimes the best investment decision is to do nothing!

As always, none of this is financial advice. Everyone should invest according to their personal circumstances, risk tolerance and financial goals.

Quote of the Day: Anthony Scaramucci

"There was a period of time when Steve Ballmer was running that company... they were flatlining at Microsoft for about eight or nine years. I would have sold that stock, didn't know I owned it, and it ended up being a big win."

This quote captures the paradox at the heart of successful long-term investing: sometimes our best investment decisions happen when we're not making decisions at all. Scaramucci's honesty about what he would have done (sold during Microsoft's underperforming years) reveals why forgetting the investment was actually the winning strategy.

We Value Your Feedback!

Your opinion helps us improve and lets you suggest topics or ask Business English questions for future issues.

How did you find this week’s newsletter? |

Word of the Day: Rebalancing

Rebalancing - verb/noun - the process of selling high-performing assets and buying underperforming ones to restore a portfolio's original target allocation; prevents any single investment from dominating your portfolio due to strong performance.

"Rebalancing is when you sell a high-performing asset and reinvest the money in another part of your portfolio - in my case, the global ETF or bonds."

Context and Usage: Rebalancing is a disciplined investment practice that maintains your intended risk level. When one asset performs exceptionally well, it naturally grows to represent a larger portion of your portfolio than originally intended. Selling some of this winner and buying assets that haven't performed as well feels counterintuitive but prevents excessive concentration risk.

Note: Rebalancing is different from market timing. You're not predicting which assets will perform best; you're simply maintaining your target allocation regardless of recent performance. Most investors rebalance annually or when allocations drift beyond specific thresholds (such as 5% from targets).

Common Collocations:

Portfolio rebalancing - adjusting investments to maintain target allocation Annual portfolio rebalancing ensures that strong stock market performance doesn't leave you overexposed to equities relative to your risk tolerance.

Rebalancing strategy - systematic approach to maintaining allocation My rebalancing strategy involves reviewing my portfolio once or twice yearly and adjusting when any asset class exceeds its target by more than 5%.

Automatic rebalancing - scheduled portfolio adjustments without manual intervention Many robo-advisors offer automatic rebalancing, which maintains your target allocation without requiring you to remember or take action.

Rebalancing threshold - percentage deviation that triggers portfolio adjustment Setting a rebalancing threshold of 5% means you only adjust when an asset class drifts significantly from its target allocation.

Tax-efficient rebalancing - adjusting portfolio while minimising tax consequences Tax-efficient rebalancing might involve using new contributions to buy underweighted assets rather than selling winners and triggering capital gains taxes.

Business Example: The pension fund's rebalancing policy required quarterly reviews, with adjustments made whenever equity allocation exceeded 65% or fell below 55% of the total portfolio.

Investment Context: Rebalancing forces you to "sell high and buy low" systematically - the exact opposite of emotional investing, which tends toward "buy high and sell low." While it may feel wrong to sell part of your best performers, rebalancing prevents portfolio concentration risk and maintains the risk-return profile you originally chose. However, as Scaramucci's story demonstrates, even rebalancing has limits: sometimes the best long-term strategy is simply holding quality investments and doing almost nothing.

Interactive Quiz

What's your biggest challenge with long-term investing? |

How often do you review your investment portfolio? |

Whenever you are ready, here is how I can help you:

We provide Business English lessons and Cambridge and IELTS preparation courses.

You can book a free 20-minute consultation with Iain over Zoom here:

Why not subscribe to our sister Business Fluency newsletter? It helps English students master essential business terms and provides practical strategies to boost your career prospects.

Disclaimer:

This newsletter is for informational and educational purposes only and should not be construed as financial advice. The information contained herein is generic and does not take into account your individual financial circumstances. You should always consult with a qualified financial professional before making any investment or financial decisions.

Additionally, the authors and/or publishers of this newsletter may hold investments in securities or other financial instruments mentioned herein. These are included for illustrative purposes only and should not be taken as a recommendation to buy or sell such securities or financial instruments.